This is a proposal to include OST as a collateral asset.

- Who is the interested party for this collateral application?

The asset originator, New Dawn US, is represented by Ryan (ryan@newdawn.io, Managing Partner at New Dawn) and Jake (jake@newdawn.io, Managing Partner at New Dawn).

UPRETS is providing the digital security issuance technology and framework for bringing real estate assets to MCD. The main contact for the application is Ran Wei (ran@uprets.io) of UPRETS as well as Wesley Ma (Wesley@uprets.io).

- Provide a brief high-level overview of the project, with a focus on the applying collateral token.

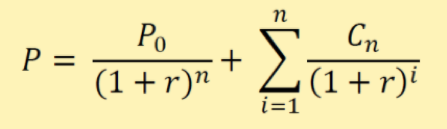

OST is asset-based digital securities based on advanced digitalization technology designed for global real estate investors and blockchain enthusiasts. With offices in New York, Dubai and Beijing, entwined with its extensive range of strategic partnerships, the international digitalization platform UPRETS aids in developing the non-fungible tokens to create a legally compliant real estate financial product available for investors with revolutionary spirits. Secondary trading on MERJ Exchange further facilitates KYC/AML, market assurance and trading liquidity. For more information, go to https://www.uprets.io/#/events/merj.

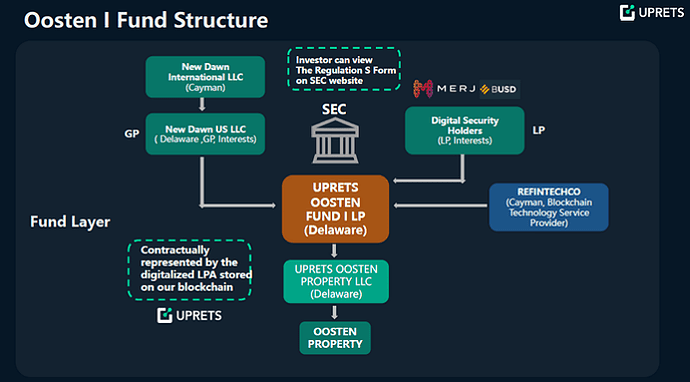

The Omnilayer & self-owned patented consortium chain Xbolt secures the OST digital securities structure and its compatibility to mainstream public chain and secondary exchanges and enables support payment with FIAT and BUSD. The ownership is issued to investors in a robust, secure and trusted digital securities form to accumulate steady dividends at a steep discount, which there will always be a demand for global real estate investors.

- Provide a brief history of the project.

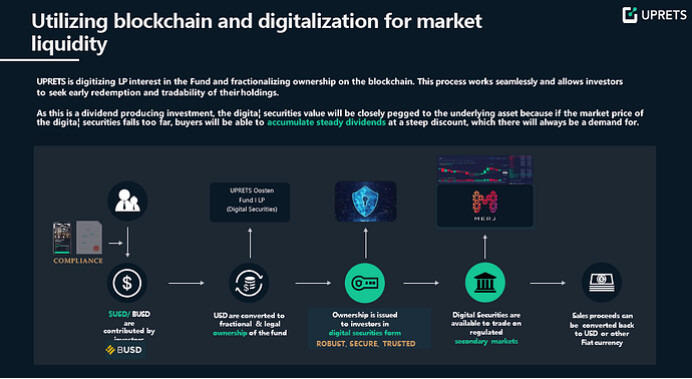

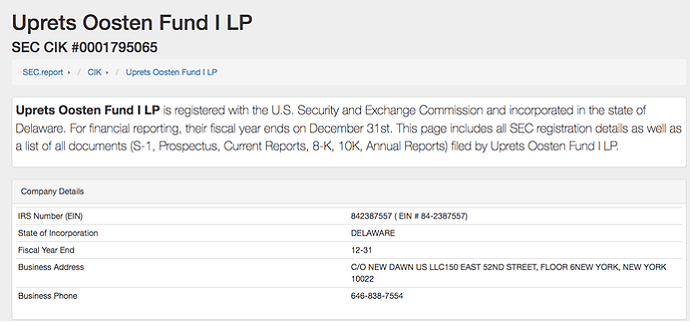

OST is the phase I legally compliant digital securities of the Oosten project, corresponding to the limited partnership interest of UPRETS Oosten Fund I LP, a real estate fund company located in Delaware, USA that holds the apartment No.730. UPRETS Oosten Fund I LP was completed through private equity investment on March 13, 2020, in compliance with the U.S. SEC’s Reg D and S standards, and simultaneously issued 100 million corresponding OST digital securities through the digitalization technology platform, UPRETS, and was listed on the MERJ Exchange on June 5, 2020, and opened the first transaction on June 25, 2020.

- Link to the whitepaper, documentation portals, and source code for the system(s) that interact with the proposed collateral, and all relevant Ethereum addresses. If the system is complex, schematic(s) are especially appreciated.

Website:uprets.io

OST Contract Ethereum Address: 0x6cF9Cc747026945654b596a6a14a675347C2FD70

OST and Oosten Property Brochure: (English ver.) https://github.com/FAN-finance/Description_OST/blob/main/OST%20Brochure_en.pdf

(Chinese ver.) https://github.com/FAN-finance/Description_OST/blob/main/OST%20Brochure_cn.pdf

UPRETS OOSTEN FUND Formation Documentation: https://github.com/FAN-finance/Description_OST/blob/main/UPRETS%20OOSTEN%20FUND%20Formation.pdf

Oosten Property Purchase Agreement: https://github.com/FAN-finance/Description_OST/blob/main/Oosten%20Property%20Purchase%20Agreement.pdf

Limited Partnership Agreement (Executed): https://github.com/FAN-finance/Description_OST/blob/main/Limited%20Partnership%20Agreement_Executed.pdf

LP Subscription Agreement (Executed): https://github.com/FAN-finance/Description_OST/blob/main/LP%20Subscription%20Agreement_Executed.pdf

Wrapper OST (wOST) Contract Address: 0x4c17f7abdbf507f7f18113faf01fd78c94d60090

- Link any available audits of the project. Both procedural and smart contract focused audits.

Audited by EY.

- Link to any active communities relating to your project.

LinkedIn: https://www.linkedin.com/company/14482223

Facebook: fb.me/uprets2019

Twitter: https://twitter.com/uprets_io 1

Medium: https://medium.com/uprets

- How is the applying collateral type currently used?

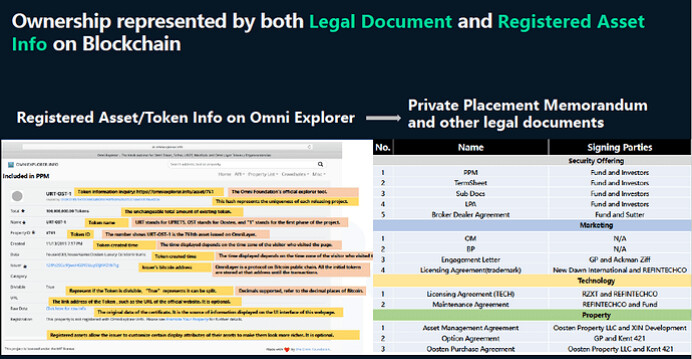

Our collateral which is the OST Digital Securities represents the limited partnership interest in UPRETS Oosten Fund I LP that is being traded on MERJ Exchange and used for enjoying the steady dividend return of the rental revenue and value appreciation of the underlying asset. We have taken the real estate property digitalized with our UPRETS integrated digitalization resolution that activates its liquidity and ensures its security and manageability. The value of each token is firmly backed-up by the assets, and determined by the current price on the MERJ Exchange.

- Does one organization bear legal responsibility for the collateral? What jurisdiction does that organization reside in?

UPRETS Oosten Fund I LP, which was registered and in legal compliance with the U.S. SEC’s Reg D and S standards, which are securely developed based on the Xbolt consortium chain that regulatorily issued on the Omnilayer, bear the legal responsibility for the collateral. Involved third-party law firms, which include Baker&McKenzie, O’Melveny&Myer and Dahui, will ensure the documentation and any related legal circumtances’ rights and liabilities.

- Where does exchange for the asset occur?

OST was listed on the MERJ Exchange on June 5, 2020, with an initial market value of US$1 million and an initial price of US$0.01 per OST. Investors who have obtained digital securities through first-level fundraising have successively transferred their OST to MERJ, and conducted the first transaction on June 25, 2020.

MERJ Exchange is the only registered exchange in the Seychelles. As a regulated market, MERJ Exchange is regulated by the Seychelles Financial Services Authority and the Central Bank of Seychelles that follows the same exchange standards as other mainstream exchanges, for instance, LSE, NYSE, Nasdaq, CBOE and CME. MERJ is a member of the National Numbering Agency (a joint organization that includes central banks, mainstream exchanges and monitoring agencies) and is the only token exchange among them. MERJ is also an affiliate member of the World Federation. As of July 16, 2020, MERJ has listed 43 securities. Since its listing, OST has achieved eight transactions and the bilateral transaction volume has reached 298,924 tokens.

- Has your project obtained any legal opinions or memoranda regarding the regulatory standing of the token or an explanation of the same from the perspective of any jurisdiction? If so, those materials should be provided for community review.

Further details can be retrieved from the aforementioned UPRETS OOSTEN FUND Formation Documentation, at: https://github.com/FAN-finance/Description_OST/blob/main/UPRETS%20OOSTEN%20FUND%20Formation.pdf

- Describe whether there are any regulatory registrations for the token and provide related documentation (including an explanation of any past or existing interactions with any regulatory authorities, regardless of jurisdiction), if applicable.

OST is a private offering by UPRETS Oosten Fund I LP, a Delaware limited partnership (the “Partnership”), of securities limited partnership interests (“LP Interests”) in the Partnership made in reliance on Regulation S (“Regulation S”) under the United States Securities Act of 1933, as amended (the “Securities Act”), solely to non-U.S. persons (as defined in Regulation S) who are outside of the United States (the “Regulation S Offering”). The limited partnership interests are expected to initially be issued in book entry form. At the election of the holder, the Partnership expects to tokenize the LP Interests in the form of uncertificated digital securities prior to the expiration of a distribution compliance period (in tokenized form, a “Token”, and LP Interests in book entry or Token form, a “Security”).

The Partnership is a newly organized Delaware limited partnership with no operating history and no material assets. The general partner of the Partnership is New Dawn US LLC, a newly formed Delaware limited liability company (the “General Partner”). Concurrently with the Regulation S Offering, the Partnership may undertake a private offering of Securities in reliance on Regulation D under the Securities Act (“Regulation D”) solely to U.S. persons (as defined in Regulation S) who are accredited investors (as defined in Regulation D) and who are in the United States.

Concurrently with the closing of the Regulation S Offering, UPRETS Oosten Property I LLC (“Oosten LLC”), a Delaware limited liability company and wholly-owned subsidiary of the Partnership, will purchase a one bedroom condominium unit (the “Property”) in a condominium development in the Williamsburg neighborhood of Brooklyn, New York, USA.

OST Digital Securities have not been and will not be registered under the Securities Act of 1933, as amended, or any other law or regulation governing the offering, sale or exchange of securities in the United States or any other jurisdiction. The securities offered in the Regulation S offering may not be offered or sold in the United States or to or for the account of U.S. persons (as defined in regulation S under the Securities Act) except pursuant to an exemption from the registration requirements of the Securities Act. This Regulation S offering is being made solely to persons who are not located in the United States and who are not U.S. persons (as defined in regulation S under the Securities Act) in reliance on Regulation S under the Securities Act. The issuer has not been, and will not be, registered under the investment company act of 1940, as amended.

No offers or sales of OST digital securities will be made in the People’s Republic of China or to PRC nationals or in any other jurisdiction where is its unlawful to sale or own the securities.

- List any possible oracle data sources for the proposed Collateral type.

All relevant self-captured Oracle data can be retrieved from: https://www.fan.finance/#/oracle. However, only partial essential data is presented at the front-end, if need, could ask for API portal to have access to all back-end database.

- List any parties interested in taking part in liquidations for the proposed Collateral type.

There will be two options depending on the volume:

Low to mid volume: The liquidation will be in addition to the above directed towards preferred global real estate investors and blockchain tech enthusiasts.

Mid to high volume: The liquidation will be through MERJ Exchange:https://merj.exchange/.

DeFi (Decentralized Finance): Use OST as the collateral and get liquidity in the FAN system: fan.finance.

- List the Wrapper Contract and Cross-Chain Contract Address:

Wrapper Contract: 0x4c17f7abdbf507f7f18113faf01fd78c94d60090

Cross-chain Contract: already developed and undergoing internal testing now. Will disclose detailed info in late May to early April.