Can Wing make a Borrow APY and Supply APY Calculator by entering Utilization Rate (%) for each asset ?

Bump. We need to Calculate the APY after supply/borrow transaction excuted

And it would be nice to have some announcement and time in advance before dividing by 2 the WING distribution of the entire pool.

As well as other important parameters.

Correct me if I’m wrong, please

WING distribution APR for a valid asset borrower is proportional to the asset Valid Utilization Rate. Docs

Valid Utilization Rate ( VUR ) = Valid Borrow / Supply

- pWING VUR = 0.763025334 | incentive borrow APR 2.92%

oneWING VUR = 0.823709525 | incentive borrow APR 14.23%

USDT VUR = 0.634433896 | incentive borrow APR 2.37%

USDC VUR = 0.792604618 | incentive borrow APR 7.71%

DAI VUR = 0.798229809 | incentive borrow APR 2.31%

UST VUR = 0.896288169 | incentive borrow APR 18.44%

It doesn’t look proportional at all.

Assume oneWING now has a Distribution Weight ( DW) = 1x as stated in WIP-50, then

- pWING DW = 0.22x

oneWING DW = 1x

USDT DW = 0.22x

USDC DW = 0.5x

DAI DW = 0.2x

UST DW = 1.2x

On what basis is the Distribution Weight set and how does it change?

Seem it’s will be changed by calling method refreshCompSpeeds @Yuki

It’s will be set base on Valid Borrow i think

Here are WING Distribution of Each Pool

https://wing.finance/wingdistribution

use Wing Flash Pool (Ethereum) as an example:

Asset utilization rate = total borrowed amount / total supplied amount

WING base amount (of an asset) = valid borrowed amount * asset utilization rate

WING distribution ratio (of an asset) = base amount / sum of all assets’ WING base amount

You can calculate by yourself according here.

At last, the WING distribution Weight of all the assets in Wing Flash Pools are 1x.

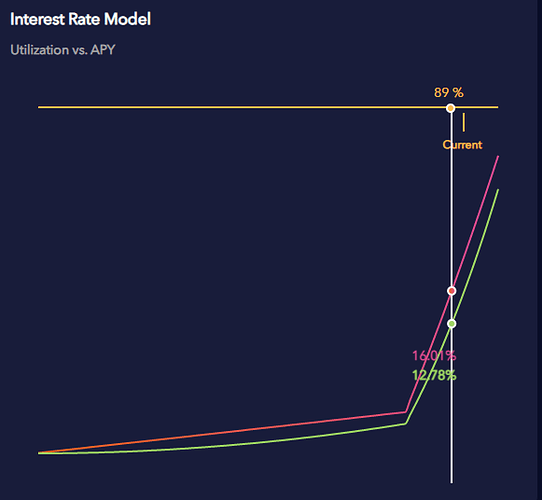

This graph looks like a kink point which is set to 80% In WIP-15 Docs

+++++++++++++++++++++++++++++++++++++++++++

Thanks for the clarification, Yuki.

So, the incentive borrow APR is proportional to the Asset Utilization Rate.

Because,

Incentive borrow APR = 0.45 * WING distribution ratio (of an asset) / valid borrowed amount

this ‘valid borrowed amount’ was a multiplier, and now it’s a divisor, so we can ignore it

this divisor ‘sum of all assets’ WING base amount’ is the same for all the pool assets, so we disregard it as well.

And we see:

pWING Utilization Rate = 0.801861154 | incentive borrow APR 2.91%

oneWING Utilization R = 0.804091416 | incentive borrow APR 15.19%

Why is the difference 5 times?

- p.s. In the docs example WING Distributed Per Second

pETH 0.02057

pUSDT 0.00823

we have to multiply these numbers by 60 * 60 * 24 * 365, then take 45 %,

but I’ll just multiply them by 1,000,000 for convenience, and it won’t break the proportion

pETH 205700

pUSDT 82300

then divide by valid borrowed amount

pETH 205700 / 500 = 4.114

pUSDT 82300 / 1000 = 0.823

exactly 5 times the difference, because their Utilization Rate 0.5 and 0.1 respectively

Four hours ago, the maximum pWING was withdrawn, now the liquidity is 0, Utilization Rate = 1,

but incentive borrow APR remained the same 2.91%

Why is the incentive mechanism formula not working properly?

I think Wing distribution to each pool can be reset by Wing dev. @Yuki is this right?. When will it’s be reset?

Why is there no way to lock different % WING to earn more WING incentives? A locked WING is an additional collateral, so it is great for general safety. The Borrow APY Calculator would be necessary and this option would make WING more attractive to hold and lock for borrowing.

I think this is not so difficult to implement, since before you had some kind of insurance incentives scheme for each asset.

Do you mean the kink point Model? We have for the time being.

In Ontology Pool, It is calculated in seconds, so the example is in seconds. In Ethereum, OEC and BSC, the calculation is based on blocks. The block time is not fixed. We calculate according to the daily distribution. The calculation formula is as follows:

Incentive borrow APR = 0.45 * WING distribution ratio (of an asset) * The Total Amount of WING distributed to the pool daily * WING Price * 365 / Total Valid Borrow

Incentive supply APR = 0.45 * WING distribution ratio (of an asset) * The Total Amount of WING distributed to the pool daily * WING Price * 365 / Total Supply

It is a good idea for Wing’s ecology, but it also raises the learning threshold of users.