We propose the launch of IF Pool, the product pool based on the OScore credit evaluation system.

Loan Products

-

IF Pool includes a supply pool, a collateral & borrow pool and an insurance pool as well.

-

Supply & borrow assets include USDT / USDC / DAI

-

Collateral assets include USDT / USDC / DAI

-

Insurance pool assets include USDT / USDC / DAI

Rules on Loaning:

-

The supply pool has a total limit of 500,000 USDT. The 500,000 USDT is available for all users to borrow;

-

A user can borrow 20 USDT – 1,000 USDT, and can only borrow again after full repayment;

-

A user can borrow one time on a natural day. The highest amount a user can loan in one day is rounded down from the user’s borrow limit;

-

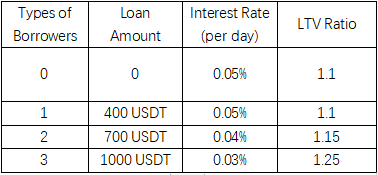

A user needs to collateralize a certain amount every time a loan is made. The basic Loan-to-Value (LTV) ratio (Collateral Factor) is 1.1. Collaterals are evaluated based on the real-time USDT value when making the loan;

-

The interest rate per day is 0.05%, with a term of 7 days. The loan can be repaid in advance.

-

The insurance pool will be locked for 3 days. The default settlement ratio of the insurance pool is 60% (of the default exposure).

Credit-based Risk Control Mechanism

Borrowers will be categorized to the following types:

The following info will be attained from off-chain data to determine which type the user belongs.

-

Whether the user has completed real-name authentication (KYC)

-

Whether the user appears on the OScore defaulters’ list

-

Certification of OScore

Breach of Contract:

-

A grace period of 1 day is granted to the borrower. Repaying within the grace period will not be counted as a default. The interest rate during the grace period is 0.08%;

-

Borrowers who default will be listed on OScore defaulters’ list, with the defaulters’ private information under protection;

-

If the borrower repays the default amount and penalty interest to the Wing DAO community fund pool after defaulting, the user will be removed from the defaulters’ list after a week. The penalty interest rate is 0.1% and is not compounded;

-

The defaulters’ list will be automatically cleared after three years.

Liquidation and Compensation from the Insurance Pool

-

If the borrower misses payments, the digital assets collateralized by the borrower will be liquidated at real-time quotes;

-

Upon liquidation, the WINGs incentives yet to be distributed to the borrower will be first liquidated to the lender at real-time quotes;

-

60% of default exposure after liquidation will be paid by the insurance pool funds (accounted in USDT). The remaining 40% will be shared by the supply pool.

WING Distribution

-

The WINGs to be distributed in the IF Pool will be released from the total distribution amount of WING, and will double the amount of USDT generated from loan interest;

-

WINGs will only be distributed to borrowers after they repay off. Borrowers who breached or who were in the grace period will not receive any WING.

-

The distribution ratios of WING to IF Pool:

Supply pool: 40% Borrow pool: 30% Insurance pool: 30%

Wing DAO Foundation

-

Wing DAO will authorize the initiators of the IF Pool to adjust the rules and parameters of IF Pool any time, and to postpone the operation of IF Pool or close the IF Pool when necessary.

-

Wing DAO fund pool will receive 15% of interests generated from the IF Pool as commission.